Support and resistance are two very important things that everyone should

know.

know.

Normally, every trader uses the supoort and resistance to take and exit their

trades.

trades.

Support and resistance are not as easy as people think; it is

not only the line that we stretch; it is more than that.

not only the line that we stretch; it is more than that.

The psychology behind support and resistance is very deep, and in this

article, we will try to cover everything that relates to the fundamental and

technical aspects of support and resistance.

article, we will try to cover everything that relates to the fundamental and

technical aspects of support and resistance.

What is support? Why should we use it?

Support is something in the market that displays the resting

position, or the position or point where the stock price will come to rest.

position, or the position or point where the stock price will come to rest.

whereas we should be using it to determine the stock price’s resting position.

For example, if the stock price is falling and we want to know the price at

which the price will stop, then we should take the example of the previous

support to determine it.

For example, if the stock price is falling and we want to know the price at

which the price will stop, then we should take the example of the previous

support to determine it.

Support can be of different types, but mainly three types are used to

determine it:

determine it:

- Moving average support: the price will be supported on the line of

the moving average from the upside.

Moving average support - horizontal line support: the price will take support at that price

level where previously our price has taken rest as an assumption of future

support.

Horizontal line support - Trendline support: the price takes support from the upside of the

trendline.

- Moving average support: the price will be supported on the line of

|

| Trendline support |

It is to be noted that support is always given to the price, which is falling.

From the three discussed above, horizontal line support is the most used and

valid support line, which is acknowledged as the best.

valid support line, which is acknowledged as the best.

Support lines are mostly used for taking advantage of buying stocks because it

is expected that the price will move upside from that support line in the

future trading session.

is expected that the price will move upside from that support line in the

future trading session.

As the support gives the buyers a great opportunity to buy the stock, so does

the horizontal line, which gives us the best way to determine the support

level of any stock.

the horizontal line, which gives us the best way to determine the support

level of any stock.

What is resistance? Why should we use it?

A thing that resists is resistance. But in trading,

resistance is a level by which touching the price of the stock

gets down or a level where the price cannot pass through.

resistance is a level by which touching the price of the stock

gets down or a level where the price cannot pass through.

For example, if the price is 100 and the resistance level is 140, then the

price will get down by touching the figure 140, or the price cannot go above

the figure 140.

price will get down by touching the figure 140, or the price cannot go above

the figure 140.

Whereas we are using the resistance level to determine the price, we can

exit our present position of the stock or we can think of selling the stock

because to sell the stock at the resistance level, our stoploss becomes less

and target increases.

exit our present position of the stock or we can think of selling the stock

because to sell the stock at the resistance level, our stoploss becomes less

and target increases.

As we talked about the support above, the resistance too has three types of

uses that are normally used by traders to determine the resistance level, or

doing which we can get the resistance level.

uses that are normally used by traders to determine the resistance level, or

doing which we can get the resistance level.

The three types are:

- Moving average resistance: the price gets touched from the downside of the moving average line,

and the line is not letting the price move upside of the moving average

as a result, creating a strong resistance.

Moving average resistance line - Trendline resistance: It is a line that is strategized with the help of the tool, and by

strategizing it, we get the resistance line where the price from the

downside touches the trendline and falls down. Basically, the line is

slanted; it is neither vertical nor horizontal.

Trendline resistance line - Horizontal resistance: it is the same as the support, but the difference is that the line is

stretched at the upside of the price to determine the resistance

level.

Horizontal resistance line

According to the above mention of resistance, the most commonly used is

horizontal resistance. It is easy to use and easy to determine the level of

resistance.

horizontal resistance. It is easy to use and easy to determine the level of

resistance.

The majority of the traders are of the view that the stocks, or any stocks,

react between the support and resistance levels. Everything happens between

these two levels.

react between the support and resistance levels. Everything happens between

these two levels.

How do we normally buy and sell using the support and resistance levels?

As far as we have learned, when the price comes to the support level, we

should be going to buy the stock. And

should be going to buy the stock. And

Whereas we sell the stocks when the stock reaches the resistance level.

That’s all we normally do, with the help of the support and resistance

levels.

levels.

But wait, there is one glitch in this, and that is that support and

resistance levels are not always going to work, as there are times when the

stock, after touching the support and resistance levels, is not going to

take support or resistance.

resistance levels are not always going to work, as there are times when the

stock, after touching the support and resistance levels, is not going to

take support or resistance.

Let us talk about two cases where the support and resistance levels worked

and where the support and resistance levels did not.

and where the support and resistance levels did not.

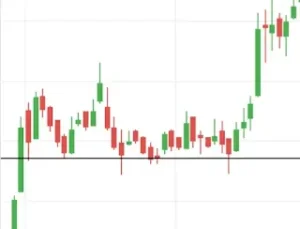

Example 1: We have taken an example of the reliance stock, where the

support level is at 400 and the resistance level is at 420.

support level is at 400 and the resistance level is at 420.

|

| Support and resistance worked |

It was a profitable trade, as we normally use the support and resistance

levels without any other tool or strategy; we use only support and

resistance, placing our orders at support 400 and selling at 420 without

judging anything.

levels without any other tool or strategy; we use only support and

resistance, placing our orders at support 400 and selling at 420 without

judging anything.

Example 2: From the lesson above, we have learned that we have done

the same thing here, but this time support didn’t work, nor did resistance.

the same thing here, but this time support didn’t work, nor did resistance.

|

| Support and resistance did not worked |

We are trying to teach you all that simply following support and resistance

is not always going to work. It may be working sometimes, but not always. To

increase its accuracy, we had to implement a strong strategy to fully

utilise support and resistance.

is not always going to work. It may be working sometimes, but not always. To

increase its accuracy, we had to implement a strong strategy to fully

utilise support and resistance.

Support and resistance in themselves is a big chapter one cannot learn

entirely and use in their trades.

entirely and use in their trades.

The simple way to use them is to make the chart simple, not complex, with

lots of tools and indicators, and scrape the chart with them.

lots of tools and indicators, and scrape the chart with them.

What is the support and resistance strategy?

The strategy that we are going to use in the usage of the support and

resistance levels is a special candlestick pattern in accordance with the

support and resistance levels that will boost the accuracy to 200%.

resistance levels is a special candlestick pattern in accordance with the

support and resistance levels that will boost the accuracy to 200%.

As we have discussed above, we use support and resistance in a normal way,

but if we use them with a bullish engulfing pattern at the support level,

then it will somehow increase the support level trading double.

but if we use them with a bullish engulfing pattern at the support level,

then it will somehow increase the support level trading double.

For example, in this chart below, we have taken a support level with

a bullish engulfing pattern, and it shows how it nicely reacted.

a bullish engulfing pattern, and it shows how it nicely reacted.

|

| bullish engulfing at support level |

Another way of trading resistance levels that will double the accuracy of

resistance level trading is to use the resistance level with a bearish engulfing candlestick pattern.

resistance level trading is to use the resistance level with a bearish engulfing candlestick pattern.

For illustration, consider the example of resistance level trading

shown below.

shown below.

|

| bearish engulfing at resistance level |

Remember, engulfing patterns are made with two candles, and the

stoploss should be below the low of the first candle of the bullish

engulfing and above the high of the first candle if it is bearish engulfing.

stoploss should be below the low of the first candle of the bullish

engulfing and above the high of the first candle if it is bearish engulfing.

Conclusion

Using support and resistance with the engulfing pattern really works and

gives a decent profit if done with consciousness.

gives a decent profit if done with consciousness.

It should be highly considered that any strategy or any special pattern will

only work if it is used with money management and patience.

only work if it is used with money management and patience.

We cannot judge any strategy by using it only one to two times; it should be

used at least 100 times to determine its accuracy and effects.

used at least 100 times to determine its accuracy and effects.

For more queries, please let me know in the comment section below.

FAQs on support and resistance strategy

Frequently asked questions on support and resistance levels.

- Are support and resistance levels indicators?

- No, it is not an indicator; rather, we use it with tools like

horizontal lines, and sometimes we judge it on indicators like

moving averages.

- No, it is not an indicator; rather, we use it with tools like

- Are support and resistance levels indicators?

- What strategy has already been discussed?

- The bearish and bullish engulfing patterns with traditional

support and resistance level strategies have been discussed

above.

- The bearish and bullish engulfing patterns with traditional

- What strategy has already been discussed?