ASIAN PAINTS LTD. shares fall under the Chemicals sector and are included in the Paints industries.

ASIAN PAINTS LTD. mainly produces paints and other things like wall primer, putty, wood primer, etc.

As of September 2024, the public holding for ASIAN PAINTS LTD. shares remains at 18.88%; the promoter has the most significant share, 52.63%. Others got 0.05% shareholding.

Please note that FII (Foreign Institutional Investors) has a 15.28% shareholding, while DII (Domestic Institutional Investors)has a 13.16% shareholding.

Asian Paints Ltd.’s diverse shareholding pattern is one of the best outlooks for investing long-term in any stock.

Some of the crucial standalone figures as of the year 2024 are:

- Earning per share (EPS) remains at 55.50; in 2023, it was 42.76.

- ROE is 28.88, and in 2023 it was 26.30.

- Total income is 31674 cr. With EBIT remaining at 7120 cr.

- Total expenditure is 24554 cr., and the net profit remains 5321 cr.

- Reserves and surplus are 18329cr.

- Net cash flow is 500.

It has one of the best balance sheets around the 2000 stocks listed in the NSE or BSE.

The price for the ASIAN PAINTS LTD. shares as of 19th December 2024, as the market is running right now, the figures may vary.

Open – 2325, High – 2325, Low – 2265.35, and close – 2284.30.

Technical analysis

As the fundamental figures are outstanding for Asian Paints Ltd., let us analyze some of the stock’s technical figures to investigate its outgoing nature further.

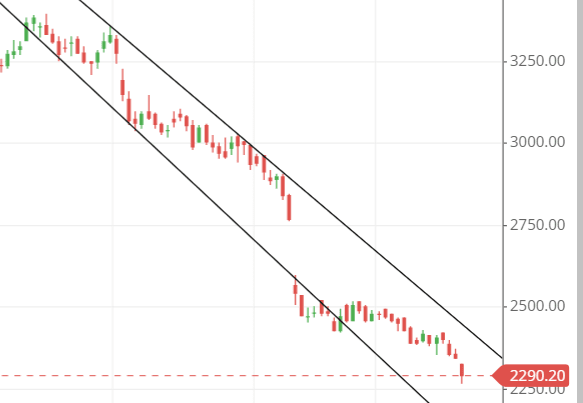

What is the trend of ASIAN PAINTS LTD. share according to the trendline?

After analyzing the stock chart, we can see that the stock is not responding as it is supposed to.

The stock is seeing a downtrend movement from the previous 2 months; it is almost a 1000-point fall, which is too surprising for a stock like Asian Paints.

But now, the stock is in the downside movement, making it bearish than ever.

ASIAN PAINTS LTD. shares SMA (simple moving average) lines.

Blue line – 50-day SMA; Red line – 21-day SMA; Green line – 10-day SMA.

The price is below the three SMA (simple moving average) line, making it a strong bearish movement in which the sellers pressure the buyers.

The trendline and the Moving average lines coincide as they both say that the stock is in a bearish trend right now, and any such bullish activity can trap the traders.

But if someone is looking for long-term, then there is no problem as the stock will react to the uptrend movement after this bearish trend is over.

Support & resistance of ASIAN PAINTS LTD. share

In this kind of bearish pressure, the stock cannot survive to touch the resistance, where it tries to break all the support previously made by the stock.

As we can judge from the stock chart, it is breaking all norms made by the stock in the past, as when the sellers are heavy, nothing comes to rescue anything to take it on the upside unless anything strong happens.

The three possible support and resistance levels are:

Support – 2200, 2100, and 2000.

Resistance – 2300, 2344, and 2377.

Chart & candlestick patterns of ASIAN PAINTS LTD. share

Candlestick pattern – all the candlestick patterns seem to be bearish, and every candle made at present makes the stock more bearish than ever because of the existing selling pressure.

Chart pattern –The descending channel chart pattern is occurring in the stock right now, as it seems when we look at the chart, which indicates the downside flow movement in the stock.

Last thought on ASIAN PAINTS LTD. Share

Short-term trading should be avoided as the stock is in downside movement, whereas intraday trading with a selling idea would be good. Within these two months, the number of red candles is huge compared to the number of green candles.

In the long term, there is no doubt that investing can commence as the stock holds a good reputation.