IRB shares fall under the infrastructure sector and are included in the Transport Infrastructure industries.

IRB mainly works on various Infrastructure projects in the road division.

As of September 2024, the public holding for IRB shares remains at 15.48%; the promoter has 30.42%.

Please note that FII (Foreign Institutional Investors) has the most significant share, with 45.99% shareholding, and DII (Domestic Institutional Investors) has an 8.12% shareholding.

It is one of the stocks in the market with a large FII shareholding percentage.

Some of the crucial standalone figures as of the year 2024 are:

- Earnings per share (EPS) remains at 1.26; in 2023, it was 0.62.

- ROE is 8.03, and in 2023 it was 4.15.

- Total income is 5850 cr. With EBIT remaining at 1611 cr.

- Total expenditure is 4239 cr., and the net profit remains 762 cr.

- Reserves and surplus are 8880.

- Net cash flow is -96.

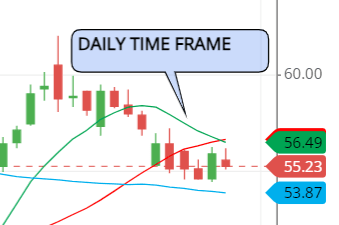

The price for the IRB shares as of 28th December 2024

Open – 55.60, High – 56.15, Low – 55.07, and close – 55.23.

Technical analysis

After obtaining the stock’s fundamental figures, let’s analyze some important technical figures to understand both situations.

What is the trend of IRB share according to the trendline?

Let us discuss the trend of the stock in different time phrases:

In Day time – the stock seems to be in a downtrend as the flow of the trendline is from up to down, and recently, the stock cut the trendline and went a little ahead, but it is still bent towards the down, which means that the stock will take a little to recover back to uptrend movement.

In Monthly time – as we are talking about the target of the share in 2025, we have taken the monthly chart to analyze it for a longer time frame for investing and analyzing factors.

In the Monthly chart, the stock is gaining momentum to the upper side, so it is in an uptrend movement as far as the Monthly chart is concerned.

IRB shares SMA (simple moving average) lines.

Blue line – 50-day SMA; Red line – 21-day SMA; Green line – 10-day SMA.

The moving average does not look good right now, as the stock’s price is in the middle of the 21-day SMA and 50-day SMA.

The 10-day SMA line is above the stock’s price, which indicates confusion in the stock, which can lead to selling.

According to the SMA (simple moving average) line, the stock is not ready to move upside as of now.

Support & resistance of IRB share

Well, if we look at the support and resistance lines of the stock in the daily time frame, then the targets that come out are very low compared to the monthly chart targets.

So, as we are talking about the target we should achieve in 2025, we need to analyze the support and resistance lines in a monthly chart frame.

The chart shows that the stock has jumped after touching the support level, around 50, and is preparing to touch the nearest resistance level, around 65.

The three possible support and resistance levels are:

Support – 50, 35, and 29.

Resistance – 65, 75 and 90.

Chart & candlestick patterns of IRB share

Candlestick pattern: As of now, the stock is making an inverted hammer candle in the monthly chart view, which indicates that the stock might end the present trend and start a new trend by reversing the previous trend. From bearish to bullish, as it seems in the chart and which, the candlestick is indicating.

Chart pattern: If we look at the monthly chart, we will find that the stock made a triple bottom candlestick pattern and then broke out to touch the new high.

Last thought on IRB Share

The IRB stock is reputed in the market, and the FII shareholding pattern tells us all.

As far as the target is concerned, the stock seems poised to make a new high this year.

Unless anything stops the stock from doing so, the level seems achievable this year.