In this post, we are going to discuss all about the magic of the trendline,

the most common indicator in the share market, which is used by almost all

traders.

Whether it is NSE, BSE, Bank nifty, or NASDAQ, anything in India or outside

India, it doesn’t matter what stock is there; trendline works fine anywhere,

wherever you make it.

It is true that there are no traders in the world who don’t use the benefits

of Trendline.

Small and simple things are always beneficial. Whether you talk about the past

or the future, trendlines are and will be beneficial for traders and

investors.

Let us point out all the pros, cons, and factors of using trendlines.

Trendline

You will see many definitions of the trendline on Google, but the fact is that

they are so bulky and big that the main essence of the definition skips

anywhere in that lengthy definition.

As we know, simple things are always very complicated to understand because we

people are so indulged in this mixed-up world that our minds become so narrow

that we knowingly reject understanding the perfect simple way of using or

applying trendlines to our stocks.

Simple meaning of a trendline

- low to lower

- high to higher

Low to lower: it is not just connecting low to lower; it

seems to be very simple. The newbies get stuck on this. What they think is

that after connecting the lower and upper, the making of a trendline is

complete, but there are lots of factors involved in making a perfect

trendline. Follow these steps before making a trendline that has a

downside:

- Take a line tool and stretch the downside with one point of the line

touching the low and the second point touching the lower-low. - After completion of the first step, check once more whether you have

touched both the low and the lower low of the stock on which you are

trying to make a downside trendline. The making of the downside

trendline is complete.

High to higher: as we have done the downside trendline

above, the same procedure has to be followed here to make an upside

trendline, to see the upside movement of the stock. Follow the steps to

make an upside trendline.

- Take a line tool and make sure that you attach one point of the line

tool to a high and the other one to the higher high to complete making

an upside trendline. - After complete making, make sure you check once more to be sure about

the making of the perfect upside trendline.

- [accordion]

- High to Higher

- Low to Lower

Is close important for the trendline?

But the answer is definitely one of the biggest mythbusters among the

traders of today’s world.

candle, then you are going to miss the perfect making of the

trendline. If you think that high and low are important for the making

of the trendline, then you should not forget to see the close of the

candle to be very accurate in the making of the perfect profitable

trade.

close and become a support if it is coming down and a resistance if it

is going up, and if the reverse happens, then there is the possibility

of the stocks gaining in the opposite direction.

How to make a trendline following the close of the candle

and low stretching of the trendline to the stock.

|

| Close to close stretching of trendline |

trendline for the stocks following the close of the candle, just see

that you are attaching the high close to the higher close.

remember is that you should attach the low close to the lower close.

Can a trade be taken only on the basis of the close trendline?

made following the close of the candle of the stocks.

charts, patterns, lines, and indicators, can boost the accuracy of the

trades. Somewhere down the line, it is true, but not wholly. If you

look at only one thing, then you are also going to make a good profit.

Coming down to the question, yes, only a trendline following the close

of the candle can make us profitable.

because if the stock is not going above the close figure, then there

should be

a future prediction of the opening of the candle for the second day if

we are trading the stocks in a day chart.

Open to Open stretching of trendline

rarely used in trading. There are two ways of looking at this, and they

are:

- open higher to high: it simply means that we are going to stretch the

line on the bearish candle because if the open is higher than close,

then it simply means that the candle is a red or bearish candle.

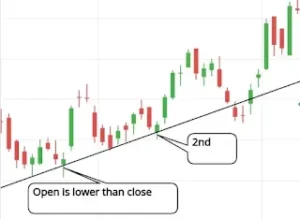

Higher to high open trendline - open lower to low: simply by stretching the line from the lower to the

low of the candle, this is probably going to be the bullish candle

because if the open is lower than the close, then the candle is

bullish and ends in closing green at the close of the trading

session.

Lower to low open trendline

higher, low to lower, close to close, and open to open.

has been discussed here, as have the ways in which trendlines can be

stretched.

Types of Trendlines

- one-side trendline: which is basically stretched on the one

side of the chart or the stocks of the market on which we are applying

the trendline. and - two-sided trendline: this is basically known as the parallel

trendline, which is stretched on both sides of the candlestick,

following the low to high, open to close, or both.

remember in the trading atmosphere because they are not randomly

happening; there is some importance in their happening, and if we perceive

correctly all that, then trading would be profitable and less loss could

happen.

Where do we get the trendline option in the chart?

- Login to your trading-associated account.

- Then go to your marketwatch, where you all save your stocks, or just open any candlestick chart.

- If your account is in zerodha, then as soon as you open your chart, you will see a pencil icon written as Draw. Click on it.

- Then select tools and select lines.

- Go to lines and select the line (this is the tool with which we are going to use it as a trendline).

Live example on Trendline

Verdict: downside or bearish.

Why have we stretched the two-sided trendline here and not in the other stocks?

What we have learned from the live example above is:

- Trendlines can be wrong if they break on one side and instantly break on the other side. Basically, it is not wrong; actually, we have to be with the trend, that’s all.

- After the candle breaks on any side of the trendline, it may take time to react on the side on which it is breaking.

- Lastly, the trendline can react perfectly as per our study.

pros and cons of trendlines

- Trends can easily be predicted, as they help find the trend of the stock.

- It is time-consuming as the trendline changes with time, so to check the perfect trendline, it takes time.

Last thought on trendline

FAQs on Trendlines

- Does the trendline represent all we need to trade?

- No, there are many other factors we need to know before trading. The trendline is one factor that should be important to follow to take any trade.

- How accurate is the trendline?

- Well, it depends on your perfection in how you use it. There are certain cases where the trendline does not work at all; for example, when the trendline is saying something but at the same time certain opposite news comes for the stock, hence rejecting the trendline.

- Does the trendline represent all we need to trade?