The Ultimate Guide to ELSS Mutual Funds: Tax Benefits, Methodologies, and Top Picks for 2026

Introduction: The Tax Saving Season

With the new year, the tax-saving season begins. While, fundamentally, it is not the right approach to focus on your tax savings only during the Jan-March period. It should instead be a year-long activity. But, well, that is how it is. As people become more active in their tax planning, they start looking for the best tax-saving or equity-linked savings schemes to invest in and save taxes.

We often consider mutual funds as an investment option. But very few people know that, through mutual funds, we can save on taxes while investing. And mutual funds that save tax are called ELSS mutual funds.

What Are ELSS Mutual Funds?

ELSS Mutual funds, or the tax-saving funds, as the name implies, help investors save taxes under Section 80C of the Income Tax. ELSS means Equity Linked Savings Scheme. And ELSS mutual funds invest mainly in equity or company shares.

- Asset Allocation: They must invest at least 80% of their assets in equities, including large-, mid-, and small-cap companies.

- Lock-in Period: 3-year lock-in.

Who Should Invest in ELSS?

- Old Tax Regime: Anyone who has opted for the old tax regime and is Those seeking tax savings under section 80C can invest in these funds.

- New Tax Regime: If you have opted for the new tax regime, you may skip investing in these funds, as tax savings under section 80C do not qualify under the new tax regime.

Detailed Breakdown: How Tax Saving Works

We know that we have to pay tax on our income. As our income increases, so does our tax bill. Keeping this in mind, the Indian government introduced Section 80C, under which if we invest our income in ELSS mutual funds, we don’t have to pay any tax on that income.

Friends, we know that if our yearly income is less than Rs. 250000, then we don’t have to pay any tax. But if our annual income exceeds Rs. 250000, we have to pay tax on it.

A Practical Calculation Example

For example, if our yearly income is Rs. 500000, we don’t have to pay tax on Rs. 250000, but we do have to pay tax on the remaining Rs. 250000.

But if we invest in ELSS mutual funds, we don’t have to pay tax on the income we invest. But friends, the important thing is that in ELSS mutual funds, we can save tax only on Rs. 150000.

Let’s assume that our yearly income is Rs. 500000 and we have invested Rs. 150000 in ELSS mutual funds.

- Now, friends, we don’t have to pay any tax on Rs. 250000 out of Rs. 500000.

- And we have to pay tax on the remaining Rs. 250000.

- But because we have invested Rs. 150000 in ELSS mutual funds out of Rs. 250000, we don’t have to pay any tax on Rs. 150000 invested in ELSS mutual funds.

- In this way, we don’t have to pay any tax on Rs. 250000 plus Rs. 150000, which is Rs. 400000.

- And we have to pay tax on the remaining Rs. 100000.

Now, friends, if we invest Rs. 200000 in ELSS mutual funds instead of Rs. 150000, then we have to pay tax on Rs. 100000 out of Rs. 500000. Because, as we said, we get tax relief only on Rs. 150000 in ELSS mutual funds. So, it doesn’t matter whether we invest Rs. 150000 or Rs. 200000 in ELSS mutual funds. We will get tax relief only on the amount of Rs. 150000 in ELSS mutual funds.

Understanding the Lock-in Period: SIP vs. Lump-sum

Friends, one thing that separates ELSS mutual funds from other mutual funds is that we can’t withdraw our invested money before 3 years. And we call these 3 years the ELSS mutual fund’s lock-in period.

1. Lump Sum Investment

If we invest in ELSS mutual funds in a lump sum, that is, if we invest a lot of money in ELSS mutual funds at once, then we can withdraw our invested cash after 3 years.

2. SIP (Systematic Investment Plan) Investment

Or if we do SIP in ELSS mutual funds, that is, if we invest a small amount every month, then we can’t withdraw our invested money until 3 years after our monthly SIP investment.

Example of SIP Withdrawals:

For example, if we started SIP of Rs. 5000 in an ELSS mutual fund from 1st January 2019:

- Then we can withdraw Rs. 5000 SIP of 1st January 2019 after 3 years, that is, after 1st January 2022.

- Similarly, we can withdraw the Rs. 5000 SIP of 2nd January 2019 after 3 years, that is, after 1st February 2022.

In this way, ELSS is a long-term investment. And you should invest in this only if you don’t need the money invested for 3 years.

Methodology: How We Selected the Best Funds

Next, let’s quickly review how we removed the name. Let’s take a look at the methodology. We tried to balance returns, consistency, and volatility while selecting the best funds.

Step 1: 7-Year Rolling Returns

So, we started by looking at the 7-year rolling returns of all the tax-saving funds over the last 10 years, i.e., from November 2014 to November 2024, rolled daily. There are 43 tax-saving schemes. As we looked at the 7-year rolling returns, funds that had not existed for at least 7 years were automatically filtered out. We were left with 33 funds.

What are Rolling Returns?

For beginners, rolling returns are like calculating trailing returns, assuming you invest daily. It is like a daily SIP over a specific interval, then taking the average of the series of returns.

As per our methodology, if I say that the 7-year rolling return for fund A is 17.5%, it means we calculated the 7-year return for all 7-year periods in the 10 years between November 2014 and November 2024. So, we got 2464 instances of returns, i.e., 2464 7-year periods within the 10-year time frame considered. Now, the average of all the returns obtained for these 2464 instances is the 7-year rolling return of fund A, which is 17.5%.

So, we filtered out the funds that delivered returns above the category average.

Step 2: Risk and Volatility (Standard Deviation)

Next, to factor in the risk portion, we checked for the 7-year rolling standard deviation. Standard deviation measures how much a mutual fund’s returns deviate from its average.

Example of Standard Deviation:

For instance, a mutual fund has a standard deviation of 3% and an average return of 10%. The fund’s returns could range from 7% to 13%. So, standard deviation measures the volatility of the fund. The greater the standard deviation, the more volatile the fund.

Coming to rolling standard deviation, it works the same way as rolling returns. Just as we calculate daily returns over a specific time period, we calculate the daily standard deviation over the same period and then average across thousands of instances. That is termed the rolling standard deviation for that period.

Now, we removed the schemes with a 7-year rolling standard deviation below the average 7-year rolling standard deviation of the category. This gave us the schemes that have been less volatile than the category average.

Final Selection

So, basically, we filtered out the schemes that have delivered 7-year rolling returns higher than the category average while being less volatile than the category. And this gave us our list of 5 tax-saving funds. We did not rank these funds. We are revealing the names in order of size.

5 Best ELSS Funds to Invest in 2026

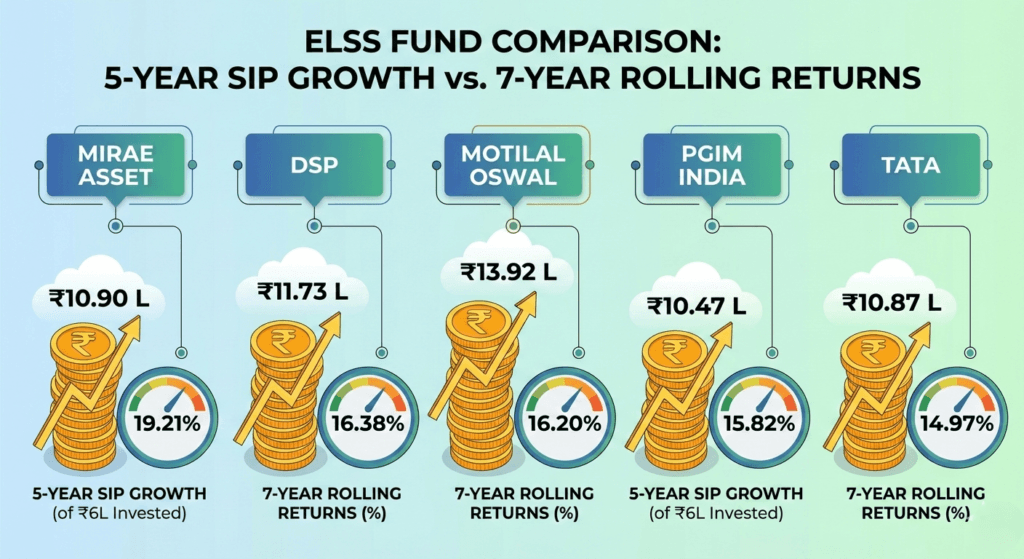

1. Mirae Asset ELSS Tax-Saver Fund

So, let’s start with the biggest fund. Managed by veteran fund manager Nilesh Surana, Mirai Asset ELSS tax-saver fund is also the third-largest tax-saving fund, with assets worth Rs 25,000 crore.

- Performance: It has delivered a 7-year rolling return of 19.21%.

- Lump Sum Growth: Now, let’s look at how much this fund has made for its investors. If you had invested Rs 1 lakh in this fund 5 years ago, it would have nearly tripled to Rs 2.8 lakh by now.

- SIP Growth: And a Rs 10,000 monthly SIP in this scheme for 5 years, where you would have invested Rs 6 lakh till date, would have grown to a massive Rs 10.9 lakh.

2. DSP ELSS Tax-Saver Fund

Then we have the DSP ELSS tax-saver fund, which is also the fourth-largest fund in the ELSS space and has delivered rolling returns of 16.38%.

- Lump Sum Growth: Now, in terms of amount, Rs 1 lakh invested in it 5 years ago would have tripled to Rs 2.93 lakh.

- SIP Growth: And a Rs 10,000 monthly SIP for 5 years would have grown your money to Rs 11.73 lakh.

3. Motilal Oswal ELSS Tax-Saver Fund

Next, we have Motilal Oswal ELSS tax-saver fund managing assets of around Rs 4,000 crore.

- Performance: It has delivered a 16.2% rolling return over the 7 years.

- Lump Sum Growth: And if you had invested Rs 1 lakh in this fund 5 years ago, you would have more than tripled your money to Rs 3.28 lakh by now.

- SIP Growth: And a Rs 10,000 monthly SIP started 5 years ago would have grown to a massive Rs 13.92 lakh.

4. PGIM India ELSS Tax-Saver Fund

With 15.82% 7-year rolling returns, we have a relatively minor fund on the list: PGM India ELSS tax-saver fund, which manages assets worth Rs 769 crore.

- Lump Sum Growth: And if you had invested Rs 1 lakh in it 5 years ago, you would have made Rs 2.64 lakh by now.

- SIP Growth: And a Rs 10,000 monthly SIP continued for 5 years would have made you an amazing corpus of Rs 10.47 lakh by now.

5. Tata ELSS Tax-Saver Fund

Next in the list is the Tata ELSS tax-saver fund, which has delivered a 7-year rolling return of 14.97%.

- Lump Sum Growth: Looking at how much this fund has made for its investors, Rs 1 lakh invested 5 years ago would have grown to Rs 2.5x, or Rs 2.57 lakh.

- SIP Growth: And a Rs 10,000 monthly SIP for 5 years would have grown to Rs 10.87 lakh.

Conclusion: Why ELSS is a Smart Choice

Friends, ELSS mutual funds are not only good for tax savings but also offer good returns. The reason is that our funds are locked in ELSS for 3 years. And then, whether it is in profit or loss, we can’t sell it before 3 years.

In this way, the ELSS fund is saved from our emotional mistakes. And funds stay in mutual funds for a long time, allowing them to generate good returns.

So, we hope you will now definitely invest in ELSS mutual funds and make good returns while saving tax.