GREAVESCOT shares fall under the capital goods sector and are included in the engineering and industrial equipment industries.

Greaves Cotton Ltd. (GCL) mainly works in Engineering fields based on diesel and other construction equipment manufacturing.

As of September 2024, the public holding for GREAVESCOT shares remains at 39.22%; the promoter has the most significant share, 55.88%.

Please note that FII (Foreign Institutional Investors) has a 1.04% shareholding, while DII (Domestic Institutional Investors)has a 3.82% shareholding. While others have 0.04%.

As the stock is new and listed on 14th February 2024 this year, the fundamental figures seem fresh and low.

Some of the crucial standalone figures as of the year 2024 are:

- Earning per share (EPS) remains at -5.83; in 2023, it was 3.37.

- ROE is -9.39, and in 2023 it was 4.91.

- Total income is 2697 cr. With EBIT remaining at -262 cr.

- Total expenditure is 2960 cr., and the net profit remains -366 cr.

- Reserves and surplus are 1393.

- Net cash flow is 61, as it was -4 in 2023.

The price for the GREAVESCOT shares as of 21 December 2024

Open – 235.50, High – 257.40, Low – 229.61, and close – 253.

The prices may vary as the market is open right now.

Technical analysis

The fundamental figures have been discussed above, and now let us talk about some of the technical figures of Greaves Cotton Ltd. Share to better identify the true nature of the stock in the present atmosphere.

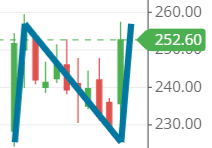

What is the trend of GREAVESCOT share according to the trendline?

If we stretch the trendline, we will find that the stock is moving upward as the flow of the trendline is from bottom to top, indicating a strong bullishness in the stock right now.

One of the things that is too interesting and enticing to call for buy is that the stock trendline angle is 45o, which is meant to be one of the finest angles of the trendline to trade in.

So, after judging the trendline, we get that the stock is experiencing buying pressure and will move upside down for the time being.

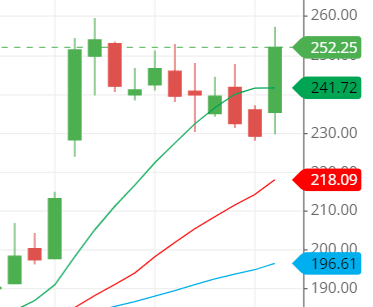

GREAVESCOT shares SMA (simple moving average) lines.

Blue line – 50-day SMA; Red line – 21-day SMA; Green line – 10-day SMA.

As the trendline supports the stock moving upside, so does the moving average line, which is doing the same as it indicates that the stock is at present in the uptrend moving and pushing the price upside to a higher price level.

The price is above the three SMA (simple moving average) line, indicating the present upside movement in the stock.

So, the SMA lines are too enticing to move the stock to the upside movement.

Support & resistance of GREAVESCOT share

After taking support at around level 230, the stock went up to touch the nearest resistance line, which is around 255.

As the stock is in an uptrend movement, it will try to react to the resistance much more than the support level.

As it moves upside down, the chance of breaking the resistance line becomes too often.

The three possible support and resistance levels are:

Support – 230, 214 and 202.

Resistance – 250, 275 and 300.

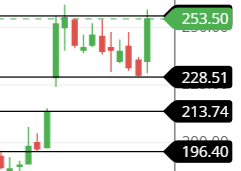

Chart & candlestick patterns of GREAVESCOT share

Candlestick pattern – thebullish engulfing candlestick pattern that the stock has right now indicates that bullishness will start in the stock.

Chart pattern – “N” shaped chart pattern, which is too bullish. If the next candle closes above the present candle, as shown in the chart, the stock price could cross the present all-time high and reach a new price height in the stock.

Last thought on GREAVESCOT Share

As we have learned from the stock’s technical figures, the stock is in an uptrend and preparing to move to a new price level.

So, buying in these scenarios would not be an incorrect decision unless anything stops the stock from doing so.