Market Overview and Valuation Triggers

Today, we will discuss 10-12 stocks with dividend triggers, where the company’s valuation is very low. FIDI has a good stake; it is a large-cap stock. As the market continues to drop, we often end up holding the wrong stock. At that time, we forget such stocks. So, let’s discuss the list of stocks; no buy or sell recommendation is being given here.

Detailed Analysis of High Dividend Stocks

1. Oil and Natural Gas Corporation (ONGC)

If we check, the first company is ONGC.

- Currently, its price is 2.43.

- Book value is 2.92; it is trading below that.

- Market cap is 3,05,537 crores.

- Stock PY ratio is 8.35, industry is 18.1. That is, it is trading at half its valuation. It has the power to double or triple from here.

- If we check the high, then it is 2.71. Currently, it is trading around 2.43. It goes up to 205, that is, it is around 52 kilos. So small investments like SIP will be significant here.

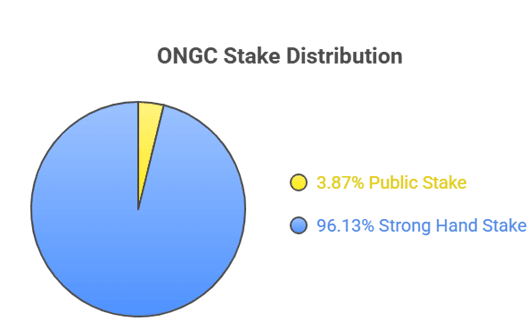

Stake Analysis:

If we check the public stake, then it is 3.87%. You can see that it is only 3.87%. That is, a firm hand has a good stake here. Pay attention to this. Who has more than 96% stake? Strong hand has a good stake here.

Dividend Expectation:

Now let’s see how much dividend we can expect and when we can do it. In Feb, the company has exited here many times. So, how much dividend can we expect? We can expect a dividend of 4 to 5 rupees.

2. REC Limited

Next is your company’s name, REC.

- If we check, when we discussed REC earlier, it was trading at 260 crores. Now it is trading at 370 crores. In between, it made a high of 385 crores. That is, people have already got a good return here.

- If we check REC, then the price is 370 crores. Book value is 317 crores.

- It is a large-cap stock. 5.60 PY ratio. Industry is 20. That is, it is at a very low valuation. It can be 4 to 5 times in the future.

- In addition, it is a well-characterised stock of 496. The low is 331. Around 330, we also discussed that it can be a good buy here.

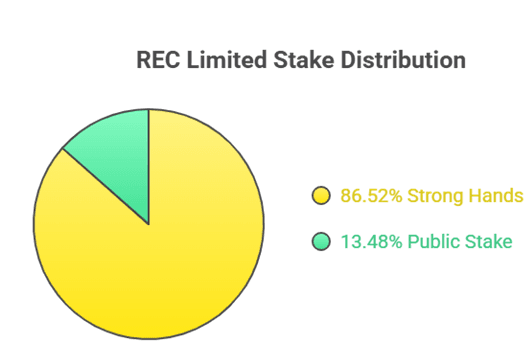

Stake & Yield:

Next, if we check the company’s dividend payout, 29.8%. Dividend yield is 4.82%. Check here too. 13.48 is the public stake. That is, if we check here too, more than 86% of the stake is with the strong hand. If you check everything, then it is perfect.

Dividend Expectation:

How much can we expect now? The company announces dividends between February and March. That is, there is no ex-date in February or March. If you pay attention to this, then the announcement comes earlier. How much can we expect here in REC? We can expect a dividend yield of 4-4.55%. Nothing is guaranteed.

3. Power Finance Corporation (PFC)

The name of the third company is PFC.

- When we covered PFC last time, its price was around 357. If you check now, it is 372. That is, people have got a good return here too.

- If you check here, 372 is its CMP. Its book value is trading below 385.

- It is a large-cap stock. 4.97 PY ratio valuation. Industry card is 20. It is at a very low valuation.

- It has a strength of 4-5%. The height is 444. It is well corrected. It has also made a low of 330.

- The dividend payout is 22.7%. The dividend lead is 4.22%.

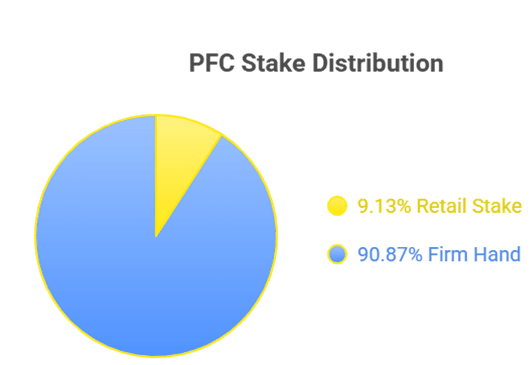

Stake Analysis:

If you check here, then the retail stake is 9.13%. That is, of the public. If you check here, it has more than 90% stake. It has a firm hand. The company’s fundamentals are excellent. It is a well-corrected, low-valuation stock.

Dividend Expectation:

When the company announces, the announcement comes first. It has an ex-date of Feb-March. How much can we expect here? We can expect a dividend of 3 to 3.50. Nothing is guaranteed.

4. ITC Limited

The next company is ITC. ITC has made a bloodbath here. It has made a low of 327. Today, there was a little reversal. We have picked this stock. Pay attention.

- The target is up to Rs.300. This is an investment-grade stock. It is a buy-and-dip stock. It can make money in the long term.

- The currency is Rs.333. It is above the book value.

- The market cap is Rs.4,16,900.

- The stock’s PY ratio is 20.7. The industry’s PY ratio is 46.3. It is a low-valuation stock. It is a profitable stock.

- It has a high of 472. It is well-corrected. It has a low of 327.

- The dividend payout is 51.7%. The dividend yield is 4.34%.

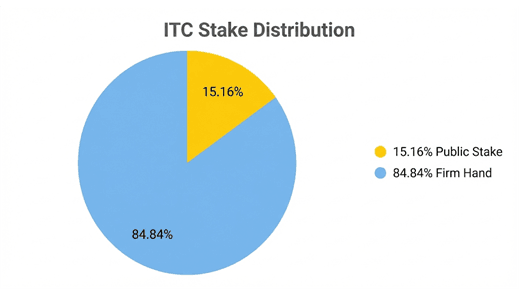

Stake Analysis:

The institution has a good stake. The public stake is 15.16%. If we check here, it shows an 84% stake. It is a strong stock. There is nothing to worry about.

Dividend Expectation:

There is an update from the company. The company can announce the dividend. When? On 29th January. The company will transmit the dividend. 29th January is an essential date for ITC. How much can we expect? We can expect a dividend of Rs.6-7.

5. Bharat Petroleum Corporation (BPCL)

The company’s name is BPCL. Bharat Petroleum Corporation. BPCL is the name of the company.

- Currently, the price is in the range of Rs. 360.

- If we check here, the market cap is Rs. 1,56,078. An outstanding large-cap stock.

- 7.26 is the PY ratio. Industry is trading at Rs.10.8.

- The company’s high is Rs.388. Currently selling in this range. The low is in the range of Rs.234.

- The dividend payout is 32%. Dividend yield is 2.78%.

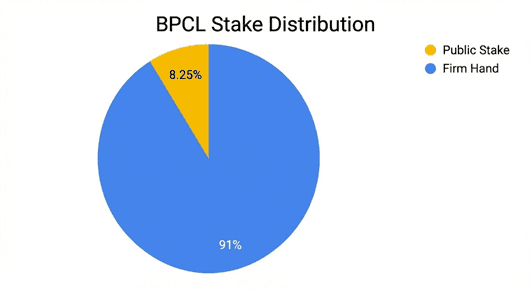

Stake Analysis:

If we check here, the public stake is 8.25%. The remaining substantial hand stake is good. If we check here, the public stake is 91%. The remaining substantial hand stake is good.

Important Note on Crude Oil:

So, this was the company’s fundamental. Another important thing is to track the crude oil prices. What is the price of crude oil? If the price of crude oil jumps, it means the price is increasing. If crude oil prices are growing, this news is very negative for oil companies. For example, Indian Oil Corporation, BPCL, and HPCL. This is very negative news. If oil prices rise, this stock should be avoided. If oil prices rise, who will benefit? If the price of oil increases, then the benefit of the stock will be. This is beneficial for stocks like ONGC. So, keep both of them in mind while initiating a COVID trade.

Dividend Expectation:

Now, one more important thing is how much dividend we can expect from BPCL. The expectation is that we will receive a dividend of 5 to 7 rupees from BPCL. On 23rd January, the board of directors will meet to consider declaring a second interim dividend.

6. Banking Sector and Coal India

Bank of Barwala:

Next is the name of your company, Bank of Barwala Company, which is currently trading at 308. Here, we will also check whether there are any large-cap stocks.

- Its IPV ratio is 8.29, and the industry is trading at 8.62, i.e., a low valuation.

- It is a profitable stock, and there is no share pledge.

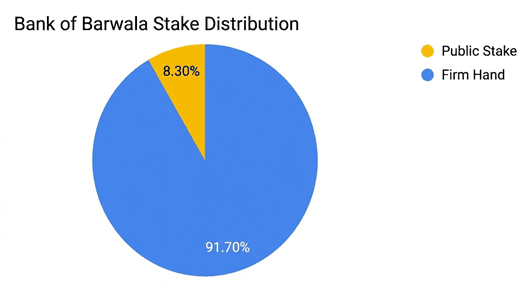

- There is no public stake; it is a high-end company.

- It is trading at 313 and could break out at any time. It is a low of 191.

- If we check here, the public stake is 8.30, i.e., more than 91% of the stake is with a firm hand.

Bank of Barwala will get a dividend update from the company in June. How much can we expect? We can expect a dividend of 7-8 Rs, which is quite a distance away.

Other Banks:

In the same way, the remaining banking stocks, like Canberra Bank and Union Bank, are also affected. Here, there is also a dividend trigger, which can break out at any time.

- Canberra Bank pays a dividend of 4 Rs. It usually announces a dividend in June. So, there is a time for June.

- Union Bank can expect a dividend of 3-4 Rs in July.

Coal India:

The next company is called Coal India.

- It is currently trading at 4.30. The stock has already run a lot. We started the stock at 370. The IPO update was coming from the company. It was discussed in 398. Now it is at 4.30. The stock has already run a lot. You should consider buying on a buy-and-dip.

- It is a large-cap stock. The PY ratio is 8.46. It is trading at 13.4.

- We will check the 52k high. It is showing 4.42. Before this, the company traded at 5.50. Pay attention to this.

- The dividend payout is quite good, 46.2%. The dividend yield is 6.17%.

- The public stake is 5.98%. If we check, the stock has a firm hand.

Coal India has many traders. It is considered one of the best dividend-paying stocks in India. The company announces a dividend in January-February. The company announces a dividend in February-March. We can expect a dividend of 5-6rs.

7. Wipro, IOC, and GAIL

Wipro:

The next company is Wipro. We have caught Vipro because it was trading well in the high; now it is well corrected. Support is around 240-238, so keep this in mind.

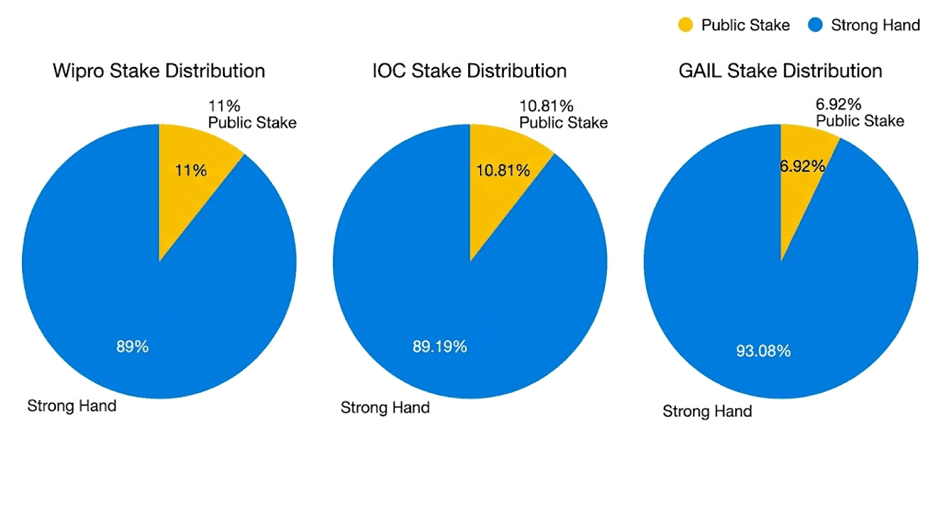

- If we check for Vipro large cap stock, 19.4% IPO, 25.2% industry, 325 low, 246 low, 225 public stake, 10.63%, 89% strong hand.

- Dividend payout 47.8%, dividend yield 4.45%.

- Fundamentals are excellent, stock is well corrected.

- The update is also coming from the company: the 6.06 dividend has been announced, recorded on 27th January. Before the 27th, it will be the 26th, so until the 23rd January, all shares recorded as of the 27th January will be eligible for this dividend. So, keep this in mind: Vipro has announced a dividend.

IOC (Indian Oil Corporation):

The next company’s name is IOC.

- 161 book value 140 large cap stock.

- 9.28% IPO 10.8% 174 161 111.

- Public stake 10.81 compare with previous quarter compare with previous quarter overall overall stake 89% strong hand fundamental is perfect.

- How much dividend we can expect from IOC? 3-4rs 3-4rs we can expect dividend from IOC ex-date ex-date from feb to march we can expect dividend from IOC 3-4rs we can expect dividend.

GAIL:

Last stock Gale.

- 165 book value 134.

- Market cap 12 EY ratio 16.5.

- 203 165 151.

- Dividend pure 39.6% yield 4.57%.

- Public stake 6.92% 93% strong hand large cap stock low valuation stock is well corrected.

- Dividend trigger 5-6.5 we can expect dividend 5-6.5 announcement can come any time ex-date ex-date.

55 Stocks Announcing Dividends

55 companies have announced dividends, including big companies.

Upcoming Dividend Announcements

- ABB India: share price Rs. 4853. This share is running in the red today. The company will announce the final dividend on 19th February.

- The second company is Krisil. This share is Rs. 4799. The company will announce the final dividend on 12th February.

- After that, the name of the next company is 502. This share is running in the red today. The company will announce the final dividend on 10th February.

- ESAB India: share price Rs. 121. This share is running in the red today. The company will announce the final dividend on 10th February.

- The name of Goldium International’s share price is Rs. 325. This share is running at 2% today. The company will announce the final dividend on 7th February.

- After that, the name of Page Industries is Rs. 34,160. This share is running at 2% today. The company will announce the final dividend on 5th February.

- The name of the next company is NHPC. This share is trading at Rs. 79. The company will announce the final dividend on 4th February.

- The name of Orion Pro Solutions is Rs. 983. The company will announce the final dividend on 4th February.

- The company is going to announce the final dividend on 5th February. The Emami Company’s name is Rs. 500. The company will announce the final dividend on 4th February.

- The name of the Communist India Company is Rs. 4018. The company will announce the final dividend on 4th February.

- The name of Castrol India Company is Rs. 185. The company will announce the final dividend on 3rd February.

- The name of Clean Science and Technology Company is Rs. 855. The company will announce the final dividend on 31st January.

- The name of Insecticides India Company is Rs. 656. The company will announce the final dividend on 30th January.

- The name of Manba Finance Company is Rs. 136. The company will announce the final dividend on 29th January.

- The name of Container Corporation of India Company is Rs. 515. The company will announce the final dividend on 29th January.

- The name of Axelia Solution Company is Rs. 1360. The company will announce the final dividend on 29th January.

- The name of Cargo Random Universal Company is Rs. 803. The company will announce the final dividend on 29th January.

- The name of Apcotech Industries Company is Rs. 350. The company will announce the final dividend on 29th January.

- The name of Great Eastern Shipping Company is Rs. 1102. The company will announce the final dividend on 29th January.

- The name of the ITC Company is Rs. 330. The company will announce the final dividend on 29th January.

- The name of CIS Limited Company is Rs. 331. The company will announce the final dividend on 29th January.

- The name of Garden Rich Shipbuilders Company is Rs. 2397. The company will announce the final dividend on 28th January.

- The name of Gopal Snacks Company is Rs. 308. The company will announce the final dividend on 27th January.

- The name of Vaibhav Global Company is Rs. 212.

- The name of Godrej Consumer Products Company is Rs. 1227. The company will announce the final dividend on 27th January.

- The name of Sona BLW Precision Company is Rs. 450. The company will announce the final dividend on 27th January.

- The name of Kirnoskar Company is Rs. 1082.

- The name of Gandhar Oil Refinery Company is Rs. 149. The company will announce the final dividend on 27th January.

- The name of Innova Captive Company is Rs. 717.

- The name of Shanti Gares Company is Rs. 416. The company will announce the final dividend on 27th January.

- The name of Orient Electric Company is Rs. 168. The company will announce the final dividend on 27th January.

- The name of IIFL Finance Company is Rs. 646. The company will announce the final dividend on 27th January.

- The name of Zensur Technologies Company is Rs. 716. The company will announce the final dividend on 27th January.

- The name of Jindal Stainless Company is Rs. 812. The company will announce the final dividend on 27th January.

- The name of Vignet India Company is Rs. 7277. The company will announce the final dividend on 27th January.

- The name of KP Energy Company is Rs. 309. The company will announce the final dividend on 27th January.

- The name of KPI Green Energy Company is Rs. 437. The company will announce the final dividend on 21st January.

- The name of KS Harvest India Company is Rs. 292. The company will announce the final dividend on 20th January.

- The name of DCM Shriram Company is Rs. 1148. The company will announce the final dividend on 20th January.

- The name of United Separates Company is Rs. 1332. The company will announce the final dividend on 20th January.

- The name of SRF Company is Rs. 2946. The company will announce the final dividend on 20th January.

- The name of Harvest India Company is Rs. 1440. The company will announce the final dividend on 19th January.

- The company is going to announce the final dividend on 20th January. The name of the Backup Maharashtra Company is Rs. 66.

- The company is going to announce the final dividend on 20th January. The name of NLC India Company is Rs. 256.

- The company is going to announce the final dividend on 20th January. The name of Angel One Company is Rs. 2701.

- The company is going to announce the final dividend on 21st January. The name of ICICI Prudential Asset Management Company is Rs. 2907.

- The company is going to announce the final dividend on 21st January. The name of DB Crop Company is Rs. 242.

- The company is going to announce the final dividend on 22nd January. The name of Central Backup India Company is Rs. 38.

- The company is going to announce the final dividend on 23rd January. The name of Suraj Limited Company is Rs. 246.

- The company is going to announce the final dividend on 23rd January. The name of the Wipro Company is Rs. 246.

- The company is going to announce the final dividend on 27th January. The name of Simulus Energy India Company is Rs. 2315.

- The company is going to announce the final dividend on 23rd January.

For more details on Stock Market Dividend Shares, please stay tuned for updates.