Ind Swift Ltd share falls under the Healthcare sector and is included in the Pharmaceuticals and Drugs industry.

The main work of the company is to make generic drugs and medicines.

As of September 2024, the public holding for Ind Swift Ltd. (INDSWFTLTD) share remains at 44.42%; the promoter has the most significant share of 55.58%.

Please note that DII (Domestic Institutional Investors) and FII (Foreign Institutional Investors) have nil shareholding.

This makes the share not that interesting to look at for long-term investing. However, as time passes and if the stock grows, it would be better to go for stock for long-term investing, whereas for now, short-term trading would be best.

Some of the crucial standalone figures as of the year 2024 are:

- Earning per share (EPS) remains at 2.63; in 2023, it was 4.81.

- ROE is -2.06, while in 2023, it was -3.69.

- Total income is 560 cr. With EBIT remaining at 79 cr.

- Total expenditure is 480 cr., and the net profit remains 14 cr.

- Reserves and surplus are -701 cr.

- Net cash flow is 49.

The figures are not that interesting, so we should look for better results in the upcoming days. The ROE is minus, and reserves and surplus are also minus.

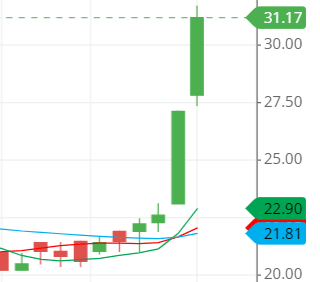

The price for the Vedanta share on 9th December 2024 is as follows:

Open – 21.01, High – 31.65, Low – 20.89 and close – 31.17.

Technical analysis

Let us analyze the technical data of Ind Swift Ltd. to analyze it better after the not-so-interesting figures of fundamentals, which tend not to entice investing purposes for the long term.

Here are some of the figures given below:

What is the trend of INDSWFTLTD share according to the trendline?

Here, we have taken the monthly chart trend of the Ind Swift Ltd. share. The trendline is flowing from down to up, which means the stock is in an upside trend right now and tends to move more upside.

If we stretch the trendline in the day chart, it will also show the same thing, which means that the trend is on the upward side, indicating bullishness in the stock.

Remember that the trend is the most crucial factor to look at in any stock analysis first.

Ind Swift Ltd shares SMA (simple moving average) lines.

The middle one is the red color line indicating the 21-day SMA, the green color line above that is the 10-day SMA, and the bottom one is the blue line indicating the 50-day SMA.

As we can predict from the chart, the moving average lines (SMAs) are in the correct order, which means that after the lesser-day SMA lines, the bigger-day SMA lines are there.

For example, the 21-day SMA line is below the 10-day SMA, and the 50-day SMA is below the 21-day SMA.

The stock’s price is above all the SMA (simple moving average) lines, which indicates a strong bullishness in the stock.

Support & resistance of Ind Swift Ltd share

The price is currently touching a strong resistance level in both the daytime and monthly charts.

Predicting an upside move would not be a brave decision or thought, as the stock is facing all-time high resistance. It would be better if we stayed neutral for some time, and if the stock closes above 35, then taking an upside position would be good.

The three possible support and resistance levels are:

Support – 28, 26 and 24.

Resistance – 31.10, 32.30 and 34.60.

Chart & candlestick patterns of Ind Swift Ltd share

Candlestick pattern— if we look closely at the chart, we will realize that the intense movement we see was due to the bullish engulfing pattern that the stock combined on 3rd and 4th December 2024.

Chart pattern—The chart pattern seems to be a rounding bottom pattern, which usually creates a “U”-shaped alphabet. This means that the bearish trend could possibly reverse into a bullish trend.

Last thought on Ind Swift ltd share

The fundamentals of Ind Swift Ltd. were not attractive, but the technical aspects were attractive. However, the stock is in a phase where it is facing the most vigorous resistance, and if it falls, recovering from it would be time-consuming.

So, it is better we give a watch to the stock for some better movement. We can get it at the best place where the price levels are decent, and the movement is not too fast.