SBI Best SIP Plan 2026: How a Small Investment Can Create Big Wealth

Today, we will learn about a specific SBI fund where you can start a SIP of just ₹1,000. Have you ever wondered how much money can be made in the next 5, 10, or 20 years with such a small amount?

If you want to know the answer and start a SIP the right way, this post is going to be very special for you. After reading this, you will not need to search anywhere else. We will look at calculations with full details to see the truth behind how much money can be generated from a small SIP of ₹1,000 in the future.

We are not here to sell you a dream; we are here to discuss the truth with complete example calculations.

The Philosophy of Quiet Wealth

This is not a scheme to become rich quickly. In fact, this is for those people who want to become rich quietly.

This SIP plan from SBI is special because you do not have to fear a market decline; instead, you take advantage of it.

- When the market falls: Your ₹1,000 buys more units.

- When the market goes up: Those same units generate profit for you.

In today’s times, you are likely working and earning a salary. Saving ₹1,000 every month from that salary is not a difficult task—you can do this easily. If you invest this small amount in this SBI fund, it can change your whole life in the coming years. It has the potential to fulfil every dream for you and your family, such as a new house, a new car, or your children’s marriage.

Fulfilling these dreams takes a lot of money, and we often cannot save it because money gets spent elsewhere. But how many returns will a SIP of ₹1,000 give you over the years? Let’s find out.

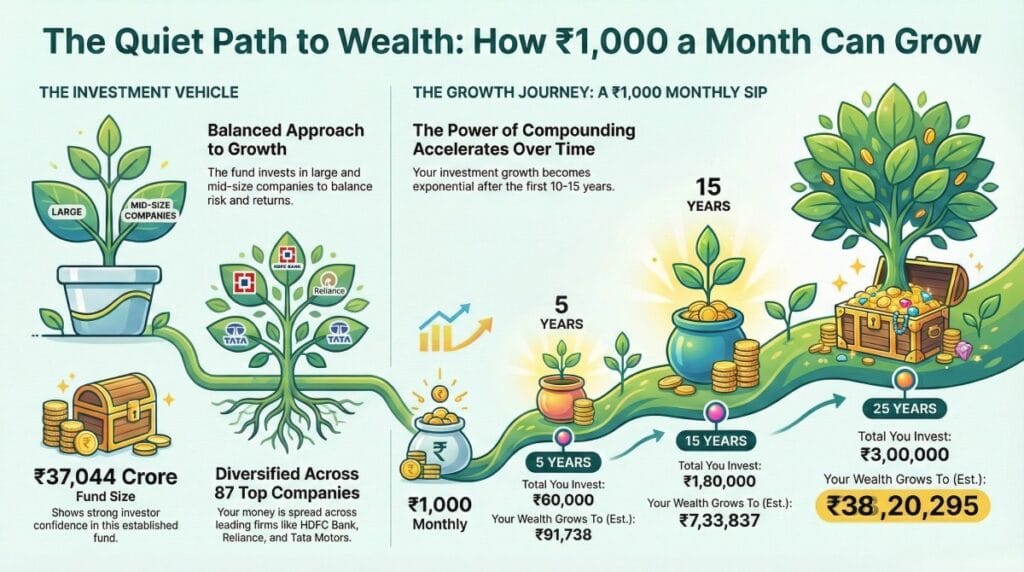

Fund Overview: SBI Large and Mid-Cap Fund Direct Growth Plan

We’re talking about the SBI Large and Mid-Cap Fund Direct Growth Plan. This fund invests in both large and mid-sized companies, which helps balance returns and lower risk.

- SBI started this fund in 2013.

- Current NAV: ₹716 (per unit).

- Fund Size (AUM): ₹37,044 Crore. This means millions of people like us have invested a massive amount of money in this fund.

Investment Rules

- SIP Minimum: You can start a SIP with as little as ₹100.

- Lump Sum Minimum: You can start a lump sum investment with ₹5,000.

- Maximum Limit: There is no limit to the maximum investment.

- Liquidity: You can withdraw your money in an emergency. However, if you cancel within 30 days, you will have to pay a 0.10% exit load. There is no charge after that.

- Expense Ratio: 0.73%. This is the charge for managing the fund; for a proper investment, this should always be low.

Past Performance Analysis

Let’s look at the returns this fund has delivered to its investors over the last few years.

| Time Period | Returns |

| Last 6 Months | 5% |

| Last 1 Year | 10% |

| Last 3 Years | 19% |

| Last 5 Years | 20% |

| All-Time Annual Return | 17.37% |

To understand this with an example: If you had invested a lump sum of ₹5 Lakhs here 5 years ago, it would have grown to about ₹12 Lakhs today. This is the power of long-term investment. However, remember that these are past returns, and there is no guarantee they will repeat.

Where Is Your Money Invested?

This fund invests your money in the top 87 companies in the country. As these companies grow over a long period, your money also increases.

Top Holdings Include:

- HDFC Bank Limited

- Reliance Industries Limited

- Axis Bank Limited

- Asian Paints Limited

- Ashok Leyland Limited

- Shree Cement Limited

- Tata Motors Limited

- Jindal Steel Limited

- Muthoot Finance Limited

There are many such companies where your money is invested. If you do a SIP of ₹1,000, your cash is invested equally across all companies. This means you might invest as little as ₹11 in a single company, which is ideal for new investors who lack market knowledge.

Wealth Calculations: The Power of ₹1,000

Now, let’s understand the potential future value in simple language with example calculations. We will assume you do a SIP of ₹1,000 and the fund gives an estimated all-time return of 17% annually.

5 Years

- Total Deposited: ₹60,000

- Estimated Returns: ₹31,738

- Total Amount: ₹91,738

10 Years

- Total Deposited: ₹1,20,000

- Estimated Returns: ₹1,72,868

- Total Amount: ₹2,92,868

15 Years

- Total Deposited: ₹1,80,000

- Estimated Returns: ₹5,53,837

- Total Amount: ₹7,33,837

20 Years

- Total Deposited: ₹2,40,000

- Estimated Returns: ₹14,60,636

- Total Amount: ₹17,00,636 (Approx.)

21 Years

- Total Deposited: ₹2,52,000

- Estimated Returns: ₹17,50,823

- Total Amount: ₹20,02,823

25 Years

- Total Deposited: ₹3,00,000

- Estimated Returns: ₹35,20,295

- Total Amount: ₹38,20,295

The Reality of Compounding

Did you see how a small saving can become a significant amount over time? This demonstrates the power of saving just ₹1,000 per month.

You might be thinking, “Who will deposit for so long?” It is essential to know that in the first few years, the power of compounding is very low in mutual funds. But as you stay invested for a long time, you will witness the true power of compounding. As seen in the calculations, after 10 to 15 years, the amount starts doubling directly.

People often start SIPs with enthusiasm, but when they see low returns in the first few years, 80% close their SIPs. They claim money is not being made. But remember one thing: no one becomes rich in a day, but you will definitely become rich one day.

Now, it is your decision whether to start a SIP.

Disclaimer: This post is made solely for educational purposes. The returns mentioned here are example-based. Returns can be less or more in the future; there is no guarantee. We never advise you to invest. Mutual fund investments are always exposed to market risk. Read all scheme-related documents carefully before investing.