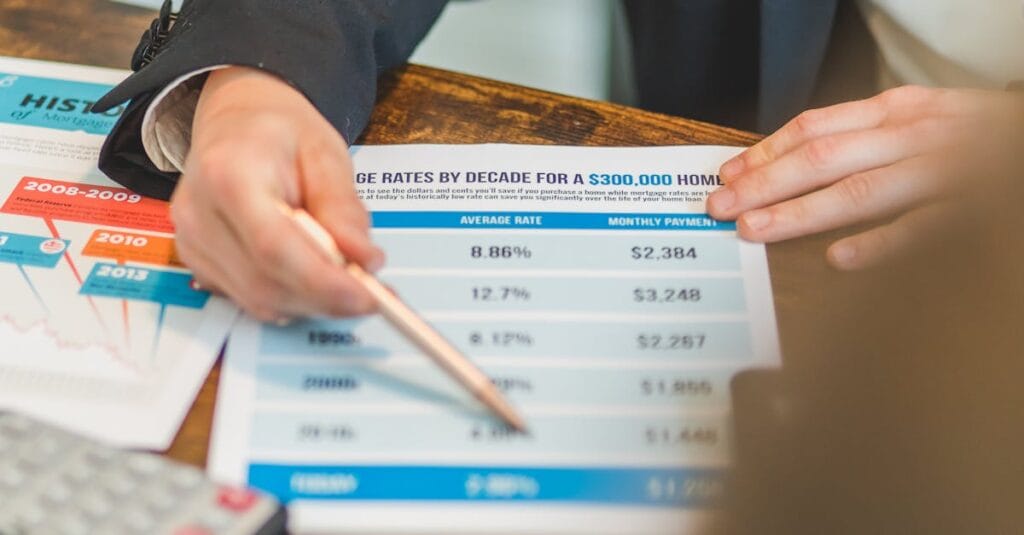

SBI Interest Rate Cuts and FD Reductions

The country’s largest government bank, State Bank of India, has made loans cheaper for its customers, but has also shocked investors by deducting interest on fixed deposits. After deducting from the Reserve Bank’s policy rate, the SBI has reduced its lending rate by 25 basis points. Loans have become cheaper for new and existing debtors.

Reduced External Benchmark Linked Rate

With this change, the SBI’s external benchmark-linked rate will be reduced by 25 basis points to 7.90%, directly benefiting home loan borrowers. On the other hand, interest rates have been reduced across various FD terms at the bank, which will reduce investors’ returns. This step of the SBI will benefit debtors, while negatively affecting savers.

Fixed Deposit Interest Rate Reductions

The bank has also reduced interest rates on FDs. India’s largest bank, SBI, will deduct five basis points from term deposit rates for maturities of 2-3 years, reducing interest rates from 6.45% to 6.40%, while interest rates will remain unchanged in other maturity buckets.

In addition, the SBI has reduced the interest rate on the Amrit Vrishti interest rate scheme by 15 basis points, from 6.60% to 6.45%. Similarly, the one-year maturity rates will be reduced from 5% to 8.75% and 8.80%. The SBI’s new rules will take effect on December 15, 2025.

MCLR and External Benchmark Changes

The SBI has also deducted five basis points across all categories from the margin cost of the funds-based lending rate. With this change, the MCLR for one year will be 8.75%, unchanged from the current rate. The external benchmark linked rate, which is automatically revised when the repo rate changes, has been reduced from 8.15% to 7.90%. All retail and MSME loan rates are determined based on the external benchmark-linked rate.

Impact on Borrowers and Savers

The State Bank of India has reduced its lending rate by 25 basis points after the RBI’s policy rate reduction. As a result, all types of loans, including home loans, have become cheaper. The external benchmark-linked rate will now be about 8%.

This is a gift for the current and new lenders. However, the bank has also reduced interest rates on FDs, which has shocked investors. Five basis points have been deducted from FDs of 2 to 3 years, and 15 basis points from the Amrit Vrishti scheme. Bihar Farmer Scheme: ₹50K-₹1L Aid in 17 Districts

Implementation Date

Five basis points have also been deducted from MCLR. SBI’s new scheme will be implemented on 15 December, which will bring lower returns for lenders and FDs.