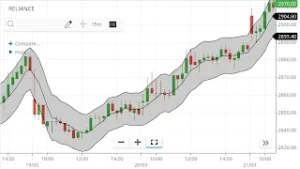

Bands indicator? We know that most of us might be wondering what bands

are.

Well, that’s what the important things are to get from the market.

Band indicators are indicators that are made to inform traders

about the market volatility of the present market or stock situation at the

present moment.

Because the volatility of the present is the utmost thing that traders are

very curious to know, trading in the volatility market is something that

should be done with lots of caution and patience.

If there is volatility and if we get to know it, then somewhere trading

becomes less harmful because it would be done with more accuracy.

So, basically, what the band indicators do is that they indicate somewhere the

possible volatility situation that exists at the present moment.

Below are the 5 best band indicators; actually, almost every band

indicator is discussed below.

5. ATR band

ATR stands for average true range. The ATR band is basically a volatility-identifying indicator; it is not

made to show you trends in the stock or anything like that, by which you can

identify the direction of the stock.

The calculation of the ATR band is very simple, and it basically goes

like this:.

If you have set your default period to 20, then.

ATR = {(Previous ATR x 19) + current True range) / 20

For the upper band, = {SMA + (current true range X multiplier)}.

For the lower band, = {SMA – (current true range X multiplier)}.

Note: SMA is a simple moving average, and the multiplier is normally set to 2.

How do I trade with the ATR band?

The most important thing is: how should we use the ATR band in our trading?

The ATR band is not an indicator that gives the buy-and-sell signal itself; it

is a volatility-measured indicator that represents the idea of the volatility

at present in the stock.

|

| ATR BAND |

There are mostly two ways in which we can trade using the ATR Band.

- support and resistance: as there are two bands in the ATR band, one

is the upper band and the other is the lower band. The upper band represents

the resistance, and the lower band represents the support. - Breakout and Breakdown: As the band is narrower, the possibility of

breakout and breakdown is low, and as the length of the band increases or

widens, the possibility of breakout and breakdown increases.

Stoploss

is set on the basis of the band size or breadth.

4. Fractal Chaos Band

It is not a very well-known indicator in the market and is not used by many

traders.

But the effect of the indicator on the chart and on the price of the stock is

shocking and useful to the traders to identify a possible way of trading.

The fractal chaos band indicator is displayed in the band and

has an upper and lower band. The lower band displayed the low price of certain

given default periods of the indicator.

The upper period displays the high of a certain default period of the

indicator.

With the help of the upper and lower bands, trades are initiated, and

decisions are made about when to exit the trades.

How do I trade using the fractal chaos band indicator?

Well, the main thing or intention behind using any indicator is to get the

idea of buying and selling the stock, just as the fractal chaos band is used.

TRENDS are easily predictable from the fractal chaos band, as when the band is

on the upside trend, it has some slope or incline on the upside, and when it

is on the downside trend, it displays incline on the downside.

But when the stock is not going either way, the indicator does flatten up.

|

| Fractal chaos band |

This fractal chaos band is used mostly for the purpose of doing two things,

and they are:

- support and resistance trading: when the price touches the lower band line, support is to be assumed, and

when the price touches the upper band line, resistance is to be assumed. - breakout and breakdown trading: simply when the upper band is broken by a bullish candle, breakout

happens, and breakdown happens when the lower band is broken by a bearish

candle.

whereas the stoploss is always made below or above the opposite

band price level.

For example, if we have bought a stock, the stoploss should be below the lower

band price level, and if we have shorted, the stoploss should be above the

upper band price level.

3. Prime number band

Prime number bands, as the name suggests, have something to do with the prime

numbers.

The prime number band indicator is not a trend-identifying

indicator; it is solely based on the calculation of the prime numbers.

The plotting of the prime number band is done with the help of prime numbers.

To plot the upper band, the nearest prime number is taken, and to plot the

lower band, the same thing is done.

|

| prime number band |

It really blows anybody’s mind how the number calculations react so much in

the market or in any stock.

How do I trade using the prime number band indicator?

This band is really gaining popularity, especially with the day trading

strategy.

There are normally three types of trading associated with these prime number

band indicators. And they are:

support and resistance: if we look at the chart, then we will find that the lower and upper bands

somewhere make a horizontal type of line that reacts as a strong support and

resistance level.

If touching the lower band support level is to be meant, and if touching the

upper band resistance level is to be taken,.

Breakout and breakout: As we have mentioned, the band somewhere draws or makes a line at the top

and bottom of the band, and if that line gets broken up or broken down, then

breakout and breakdown happen.

Pointed edge trading: this is a special kind of strategy used in this band to trade. As we have

seen many times in the band that the band is making a pointed edge or mountain

edge type of structure in the band, then the reversal or change in the price

is to be realized.

If the pointed edge is on the up side, then it is likely to be seen that the

price will go down, and if it is happening on the down side, then the price

will be seen on the up side in the near future.

Stoploss as usual: if it is a band and we are trading using it, then going long side below the

lower band is the stoploss, and if going short, then above the upper band, the

stoploss should be made.

2. High-low band

A high low band is basically a triangular type of moving average

in which three different types of moving average whose periods are not the

same are taken, and on the basis of that, this band, which is known as a high

low, is made.

The three lines in this indicator define the highest high, which is the upside

band; the lowest low, which is the downside band at the bottom; and the middle

band, which defines the average of both.

As the three lines of the band are defined above, trading with this band

becomes easier and more comfortable than with the earlier band discussed

above.

How do I trade using the high-low band?

Normally, trading with this band happens when the band is making the support

and resistance levels, when a breakout or breakdown happens, or when the price

of the stock is going or trading above the middle line of the band.

|

| high low band |

Let us discuss, one by one, how trading happens.

1. Support and resistance: support is taken when the price of the stock is taking the support on the

downside band line at the bottom from the upside, and resistance happens when

the upside band line is resisting the price of the stock from the upside.

2. breakout and breakdown: breakout happens when the price of the stock is breaking the upside band,

and when the price of the stock is breaking the downside band line at the

bottom, breakdown happens.

3. Middle line band trading: the trading in the middle line happens when the price is above it, then

buying happens, and when it is below it, then selling happens.

As it is not only the way to look out for trade, other technicals are seen to

go inside for trading, like executing our trade with the high low band using

it with the MACD, RSI, etc.

1. STARC BAND

The stoller average range channel (STARC BAND) is one of the most

popular bands to determine the volatility of the stock, and its trend can be

easily determined by using this band.

If we talk about its making, then we will find the three lines, which are the

upper band line, the midpoint, or simple average line, and the lower band

line.

Formulas are:

As we select it, we are already given the defalut figures, which should not be

changed for better use of this indicator.

For the upper band: SMA + (multiplier x ATR)

For the lower band: SMA + (multiplier x ATR)

For some of the platforms, the moving average ranges from 5 to 10.

whereas the multiplier defaults from 1 to 1.5.

How do I trade using the STARC Band?

Well, there are many ways in which you can trade using the starc band, and

some of them are:

|

| STARC BAND |

Using the midpoint or the SMA line: there are many traders who use the

midline as a buying or selling point and initiate their trades until the

target of the lower or upper band.

Breakout or breakdown: if the breakout happens to the upper band, then

buying is possible to be seen as a good trade, and if the breakout happens to

the lower band, then selling is seen as a good trade.

Support and resistance: the lower band is seen as a good support level,

whereas the upper band is seen as a good resistance level.

Stoploss is the level where the stock is very aware of it and

rarely touches it.

That level should be the stop-loss for any trade using the STARC BAND.

For example, if we are trading using the midline strategy as discussed above,

then the stoploss should be below the midpoint line.

Final thoughts on band indicators

Bands are the real way to analyze and determine the true volatility of a

stock.

But it should also be kept in mind that stoploss is of utmost importance while

using the band indicator.

Band indicators will be helpful if done with discipline and making ourselves

out when stoploss is triggered.

FAQs

Frequently Asked Questions regarding the band indicators.

- Which band indicator is the best?

- Everyone is the best, but the STARC BAND indicator still has a

special tendency to smooth trades for traders.

- Everyone is the best, but the STARC BAND indicator still has a

- Does the band indicator include the moving average?

- Yes, many of them include it like the STARC Band does.

- Which band indicator is the best?