Indian Rupee Hits Historic Low: Why is it Falling and What Does it Mean?

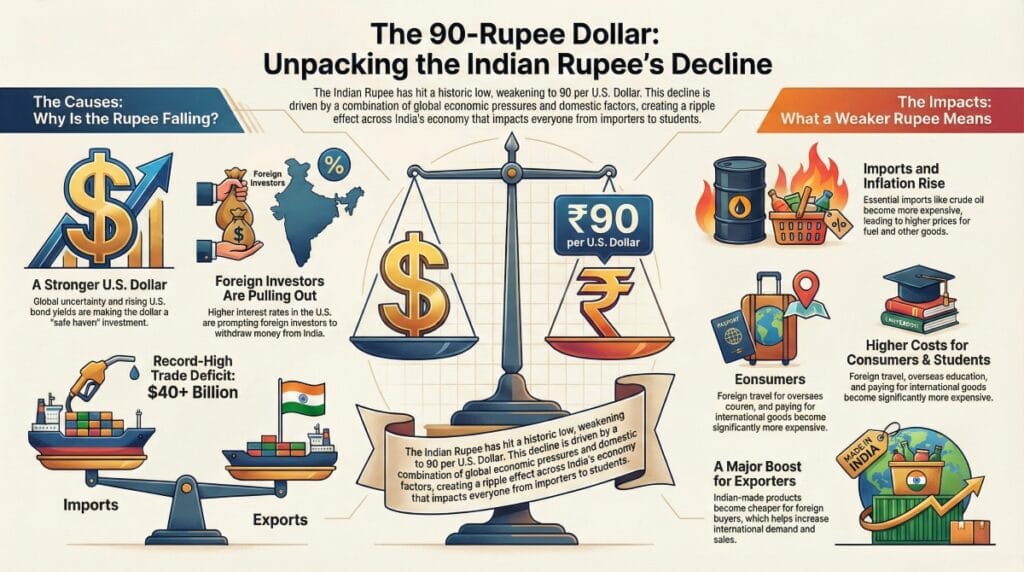

There was a time when the rupee was firm. You might remember a time when 1 dollar was equal to 50 rupees. Then, slowly, the rupee fell: 1 dollar became equal to 60 rupees, then 70 rupees, then 80 rupees, and today 1 dollar is equal to 90 rupees. Over the last 5 days, the rupee has been continuously falling.

The Indian rupee has declined sharply recently. In fact, in one day, it has dropped by more than 68 paise. And it went to 89.66 rupees per dollar. However, there is a slight improvement. But still, it is above 89 rupees. So, this decline is due to a combination of global factors.

The Mechanics of Demand and Supply

Always remember in life that whenever something goes up or down, the reason behind it is your demand and supply. In the world, whether it is a person or a currency, the more demand a person or a currency has, the more the person or the currency appreciates. And the currency that has less demand will depreciate and become weaker.

On the other hand, the more supply a currency has, the weaker it becomes. When dollars enter India, the supply of dollars increases, weakening the dollar. But if the dollar goes out, your cash weakens.

Key Reason 1: Global Factors and a Strong Dollar

The obvious thing is that whenever the dollar is strong. So, in comparison, all currencies, especially those of developing countries, are. They get a little weak here.

Recently, the government was shut down. I mean, the most extended government shutdown in American history was recently seen. So, because of all this, there is a demand for safe havens. Means towards gold, towards dollar, that increases. And because of political uncertainty, the dollar is said to have strengthened here.

Actually, over the last few years, US Treasury bond yields have increased. So, we can say the dollar is strengthening. A strong dollar means that the currency is weakening.

Key Reason 2: Foreign Portfolio Outflow

Look, the first and foremost reason for the rupee’s fall is foreign portfolio outflows. You might know that many foreign investors invest in India. But whenever they feel uncertain or afraid, they withdraw their money from the Indian market.

Why are foreign investors withdrawing money from India? The reason is that there are 2-3 reasons:

- Political Uncertainty. There are many global tensions.

- The trade deal. No one has any certainty about this.

Recently, we have noticed that interest rates in the USA are high. So many foreign investors are withdrawing money from India and investing in the US and other countries. The more dollars leave India… whenever the dollar leaves India, the dollar will be strong, and the money will be weak.

Key Reason 3: Trade Deficit

Actually, there is an economic concept known as the trade deficit. How much did you import? How much did you export?. If we import a lot of goods but don’t export that much, then what happens in that case? We see a significant trade deficit.

For the first time in India’s history. The number of our trade deficit… It has crossed 40 billion dollars. Usually, in a month, our maximum trade deficit is around 30 billion dollars.

If I want crude oil from abroad, then in what form do I have to pay for it? The answer is in dollars. Because I wish for dollars to import more. I need more dollars. So, imports have been a significant contributor to that.

Impact of a Weak Rupee

Actually, do you know what happens? The rupee’s weakness has some impact. There are some advantages and some disadvantages.

Expensive Imports and Inflation

First of all, whenever your rupee weakens, your imports become more expensive. For example, let’s say I talked about a watch. Now it is possible that I ordered this watch from abroad for 100 dollars. So earlier, 1 dollar was 80 rupees. Now it is 1 dollar and 90 rupees.

Similarly, if we order raw oil, any import we place will be expensive for us. If raw oil is becoming costly, we can see the impact of inflation nationwide.

Impact on Consumers and Students

See, whoever wants to travel. Wants to go out. Wants to travel… Dollars are used. Education. When you go out to study. That will become expensive. Goods will become costly for them. Fuel prices will become costly.

Impact on Exporters

Along with this, if we talk about the benefits of the rupee weakening, then it is beneficial for exporters. Because products made in our country become cheaper when they go abroad, people there will demand more. This will make the exporter very happy. So, the weaker the rupee is, the better it is for exporters.

Dollar Denominated Debt

Do you know what many companies do? Many companies take loans in dollars. This is called dollar-denominated debt. If the rupee is weak, then they will have to pay more rupees in foreign countries. So, their loan will have to be paid at a higher level.

The Role of RBI

Now, the question is: even if the rupee gets weak, is the RBI not doing anything? In India, we follow dirty float or mixed float. It usually means the rupee doesn’t intervene here. But if, for example, the rupee suddenly becomes very strong or very weak, then the RBI, which we know as the foreign exchange reserve, intervenes to stabilise the rupee.

Often, when the rupee is very weak, the RBI withdraws dollars from its foreign exchange reserves and puts them into the market, so that the depreciating rupee can be managed.

Experts believe. That’s a 90 level. Should not cross recently. Let us see what steps the RBI takes in the coming days.

Impact on Markets and Future Outlook

Its impact also comes on the stock market. The FIIs. Foreign Institutional Investors. Whatever they have invested in India. They start withdrawing money from there. So, the outflow increases. Because of which our stock market. Begins to weaken. So, there can be an impact on the equity market. Specifically, that sector. Where there is more turbulence. Which is more dependent on foreign imports? That will have a greater impact on the companies.

And the monetary policy. There will be a constraint in that, too. Means, RBI. See, if you look at RBI. Recently, they also gave a statement. Steady growth. Low prices. So, RBI thought. There is still room for a rate cut here. Means, the repo rate. There can be a further fall in that. But that will only be possible. When the inflation does not increase. If the inflation increases. Then there will not be a further rate cut. So, the rate cut. Again, has an impact on the EMI. Whatever interest you have to pay on the loan. It becomes less. So, this benefits the consumers. But if the rate is not cut. Then the consumers will not benefit.

Will the rupee cross 90 from here? It doesn’t seem so. Because again. The psychological level is 90. That is very important. And you will see. Whenever there is a sharp increase. Or fall in the rupee. So, RBI intervened there. It means that. Definitely, RBI must have intervened here. And how does RBI intervene? Basically, here. The remaining dollars. It starts selling it. It buys rupees. So that here. In a way. The supply of rupees is less. The supply of dollars increases.

And automatically. Slowly. The rupee starts getting better. It is not that. If RBI wants. It has brought rupee. From 80. From 90. To 50. This is not possible. Because again. Market dynamics. Works more. Experts believe. That’s a 90 level. Should not cross recently.